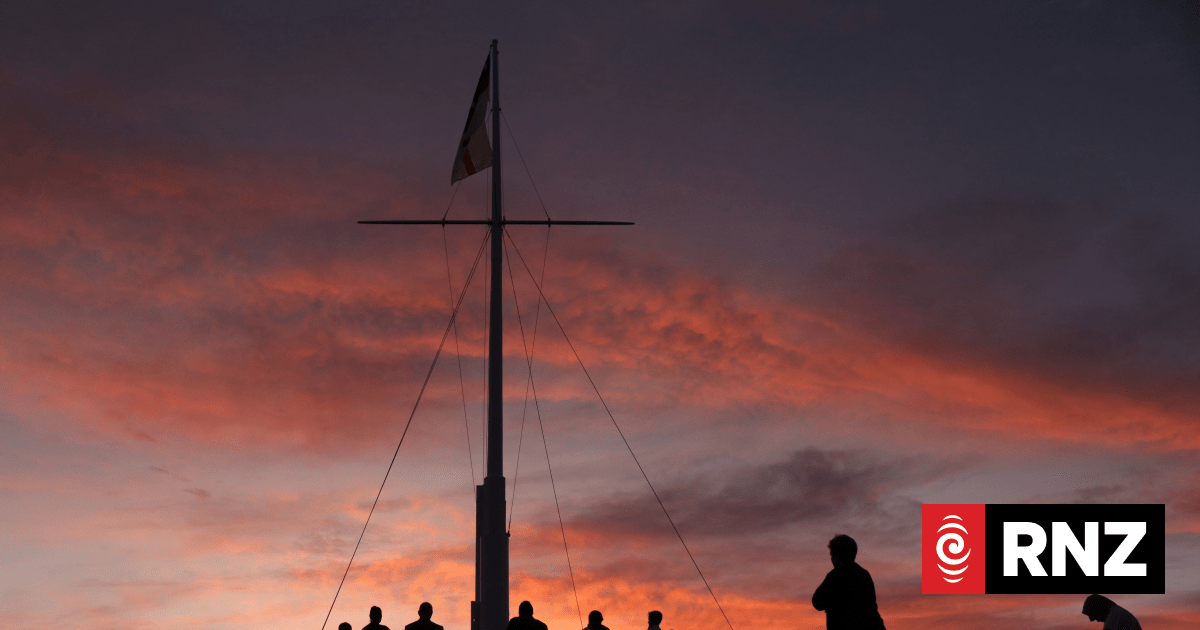

Community bankers Lisa Trist (left) and Matilda Kasek (right) teaching June (front left) and Sas (front right) how to keep their banking safe. Photo / Brodie Stone

Northland seniors are increasingly being targeted by scammers, but many are determined to fight back, by getting computer- and scam-savvy.

Attempts to scam the elderly and others have shot up since 2015. Scammers have been

busier than ever in their efforts to fleece bank customers, according to the Banking Ombudsman Scheme’s latest annual report.

Banking Ombudsman Nicola Sladden said the scheme received 535 scam complaints out of a total of 4732 in 2021-22 – an increase of 63 per cent on the previous year.

A common scam 83-year-old Whangārei woman June says she encounters is receiving a call “telling me there’s a problem with my computer”.

“I just say there’s nothing wrong and hang up on them. But I feel like I want to punish them for thinking I’m that stupid.”

June, who did not want her real name published, said when she receives emails, texts or calls that appear to be scams, it makes her feel “uneasy and damn annoyed”.

Another local woman, Sas, who does not want her full name used, agrees.

“Let’s absolutely fight back, because we may be older but we’re not stupid.”

Last the women were among a group of older people who attended ASB Bank’s “better banking” workshops in a bid to learn about how to keep their money safe, and how to fight back against scammers.

Manager for Health Promotion and Policy at Age Concern New Zealand, Joanne Reid, said while scams are an issue for individuals from all walks of life, older New Zealanders sometimes fall victim because they haven’t been exposed to technology from a younger age.

“Scams are getting more plausible, using business brand names we’re familiar with. Scammers are also very persistent. Older adults may feel less familiar with what a scam looks and feels like,” said Reid.

She encouraged people to check in with their older family members, and take the time to show them how to use online services safely.

“Some older people will need to be shown how to do something more than once,” she said.

She said encouraging people to not be ashamed if they are scammed is an important aspect of what Age Concern does. “Many people from all ages and walks of life get taken in by scams, which are sounding more and more plausible.”

Figures from cyber security organisation Cert NZ showed that scams accounted for 71 per cent of the total financial loss reported in 2021, with a total of $11.9 million.

While there are many different types of scams, Sladden said scammers have been “busier than ever” in their efforts to fleece bank customers.

The Banking Ombudsman Scheme deals with complaints from banking customers when a situation is not resolved. Often this involves investigating complaints about banking scams.

Complaints can involve financial losses of up to $500,000.

These complaints are investigated in conjunction with the relevant laws and industry standards, and the scheme has accordingly facilitated $3.41m in compensation to scam victims since 2015.

While banks are obliged to reimburse customers if funds are moved without their instruction, a reimbursement can be declined if a customer has failed to comply with the bank’s terms and conditions, or has failed to protect their banking.

This is why Sladden believes it is important people know the warning signs and how to protect their information.

Sladden said claims have been rising, and she has attributed that to the Covid-19 pandemic. She also noted that not only the volume of complaints is increasing, but the sophistication and sums involved.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/EJ7GMHTCM33ORWVBVKK5I2C73U.jpg)

According to Sladden, the most common scams include phony emails, calls and texts, in which scammers seek bank details such as verification codes. Often scams involving bank details are disguised under a ruse of offering support in order to obtain access to the victim’s online banking.

Losses from scams can take a heavy toll on the lives of victims, with consequences reaching well past financial harm to include emotional and psychological distress too.

A Whangārei woman, Bev, almost fell victim to a scam similar to this earlier this year. She recalled the encounter with The Advocate and said it was an “awful” experience.

One Friday afternoon, she received a call from a “well spoken” male, who stated he was from the “unclaimed money division” at the IRD. He gave her a fake employment number, his work address and told her he needed to verify her details.

Bev said the call seemed legitimate due to the man having little-known information, such as her licence number and version. He also knew she banked with ASB.

“You just think this is all relative to IRD,” she said.

The man then said he would get his assistant from ASB to call her. Later that day, she received a second call, which left her feeling “dubious”.

“As soon as that girl rang my suspicions started to build, I was thinking, ‘this is too good to be true’.”

The woman who claimed to be with ASB told Bev that she had too much money in her account, so she needed to open a new one.

Bev put the phone down and froze her account instantly, before reaching out to the police helpline after discovering the AA and local police department were closed on the weekend.

Scammers often call victims on a Friday as they know many organisations that can aid victims are closed over the weekend.

The following day, Bev and her husband received multiple calls on their cell phones and landline from the scammer.

“It’s just a horrible feeling and to this day I don’t know how they had this much information,” she reflected.

The scam is among many which seem to be becoming more and more sophisticated.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/B6SYWP2IZKSYWIJY5XOO57VU7M.jpg)

The better banking workshops are being held in a bid to spread awareness about scams.

ASB’s community banker for Northland Matilda Kasek is leading the workshops at the Whangārei regional office, where attendees are taught how to spot different types of scams, what the red flags are, as well as how to keep passwords and pin numbers safe.

While the better banking workshops are for anyone to attend, they are being held in conjunction with the silver festival, a series of events for seniors in Whangārei.