Classic Builders Whangarei operations manager Kane Thorne said many Northland building companies are still struggling to get gib board. Photo / Michael Cunningham

Ongoing issues with building supplies and fears rising interest rates will impact new builds are continuing to plague Northland’s construction industry.

But new figures from Stats NZ show building activity around the country has increased

in the four months to June and tradies are generally optimistic about the future, despite higher home-loan interest rates and soaring inflation which has hit 7.3 per cent.

Classic Builders Whangārei operations manager Kane Thorne said there are still problems getting building supplies.

“The main issue for Northland is Gib board. A lot of the rest of the country are better off than we are here, we’re struggling.

“We build a lot of houses, so we’re probably only getting 50-60 per cent of the Gib we need for our company alone.

“You can still get things, but you’ve got to be very proactive and order everything beforehand. If you’re not doing that it’d be a huge issue for some companies.

“The small one-off builder will be waiting a long time for his Gib board. “

Despite disruption from Covid and the struggle for materials, Stats NZ estimates a total of over 41,000 homes were built in the year to June 2022.

On Monday, Stats NZ said the volume of building activity in New Zealand rose 2.6 per cent in the June 2022 quarter, compared with the March 2022 quarter.

Residential activity rose 3.2 per cent in the June 2022 quarter, while non-residential activity rose 1.6 per cent.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/BACIN3QN2YP4GZ7ND6CS74FMTM.jpg)

Thorne said he’s noticed a slight slowing in sales which could be put down to a number of factors including “a bit of fear of the times, and all these hold-ups through construction”.

But overall, Thorne is positive.

“People still need houses, and we’re still selling houses, it’s not like it’s stopped.

“People are probably just waiting at the moment.

“I see it as a short-term slow down and we’ll come right again.”

Over the last 12 months, the Reserve Bank’s aggressive raising of rates in a bid to curb inflation has made it increasingly difficult for people to get and service a mortgage.

The average fixed two-year mortgage rate is now between 5.39 and 5.45 per cent.

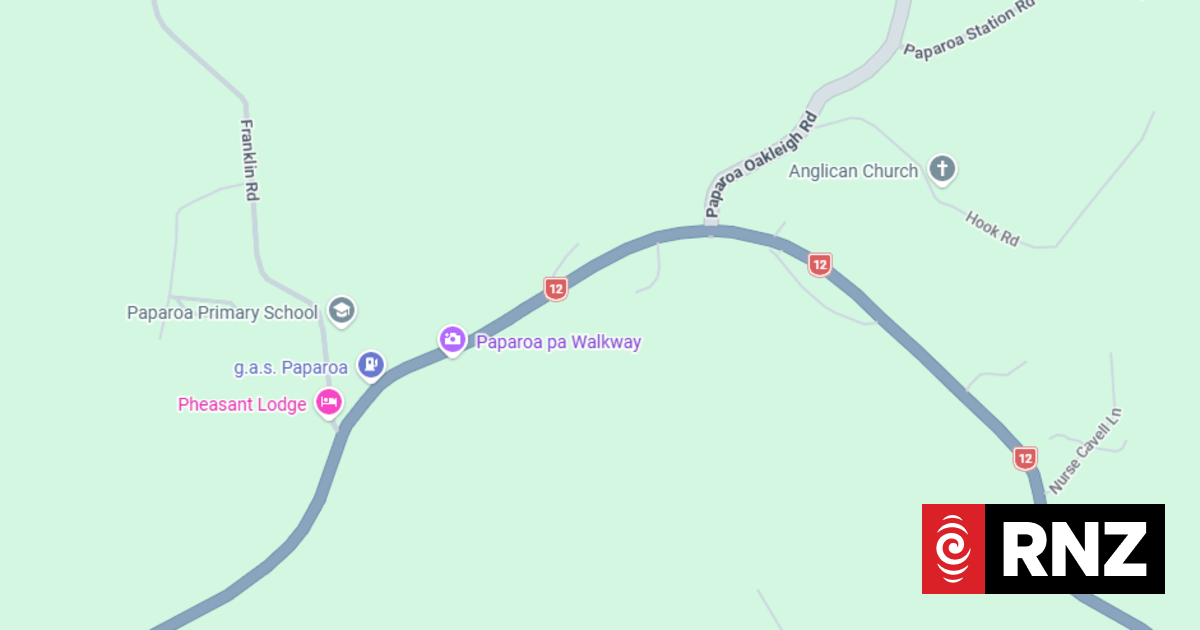

This hasn’t made a dent in the number of building consents issued in Northland, however.

Though Whangārei, Kaipara and the Far North district councils each record their consent applications differently, figures don’t suggest much of a decline.

The Far North District Council received 1026 building consent applications from January to July this year. Of those, it has issued 944. For all of last year, 1977 applications were received, though the council could not say how many were issued.

Whangārei District Council issued 979 consents from January to July 2021 and 945 over the same period in 2022, and Kaipara District Council processed 780 building consents from July 2021 to June 2022 and 783 building consents the previous year.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/YNQ2FPQ5RPEIHKDGUQI4ZGXRQQ.jpg)

Kerikeri Builders owner Joe Muller said rising interest rates and inflation were “definitely” having an impact on the industry.

“It just puts a bit of fear in the market, if I wasn’t out Kerikeri and Paihia way I’d be hit by it much harder.

“Because of the market where everyone’s got the money and are looking at retiring, we’re a lot better off.

“People will still build when they’ve got the money.”

Simon Crawford, Bella Homes director and Northland chairman of the Registered Master Builders Association said the interest rate hikes haven’t impacted him personally.

“There’s talk around of interest rates curbing the building industry a little bit but whether it’s just interest rates I don’t know.

“There’s talk of a downturn in the market, but I don’t think it’s all doom and gloom.”

The issue with building supplies was “improving”, Crawford said.

“Building supplies seem to be coming right, we’re over the worst of it, for sure. You’ve just got to plan well.

“The days where you just ring up and pick it up are gone, you’ve got to order things in advance.

“At least now you can get eta’s out – before we had no idea.”