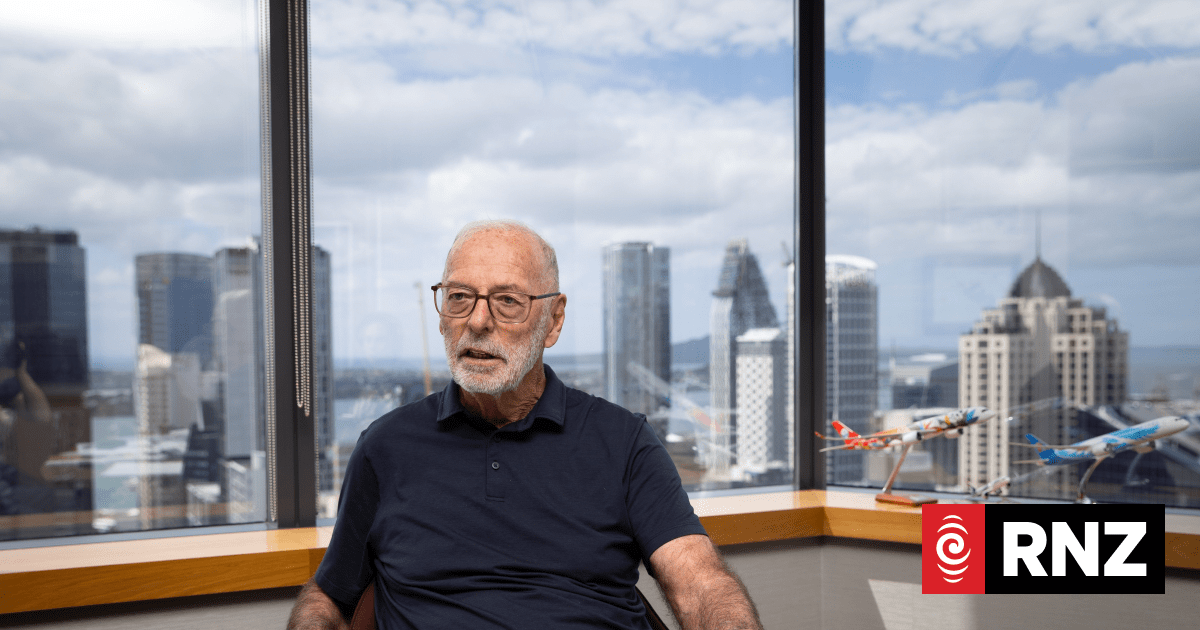

More houses are on the market this month, but this is at least partially because they are taking longer to sell. Photo / Michael Cunningham

There are significantly more properties on the market in Northland than this time last year, according to Trade Me data.

Trade Me’s Property Price Index showed property supply had risen 83 per cent in Northland,

and 67 per cent nationwide, in September.

Demand, calculated by listing views, had fallen by 16 per cent, Trade Me property sales director Gavin Lloyd said.

OneRoof editor Owen Vaughan said although new listings on OneRoof had risen slightly since June, extra supply in the market was likely due to existing stock that had not sold rather than new properties.

“March was a high point for new listings in Northland, about 200 more than came on last month.

“Monthly listings aren’t as high as they have been in previous years but the fact that sales are low and more of a challenge means there’s a lot more stock on the market.”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/EEYMERO7QZBVMBYX2FKWAJBNCI.jpg)

It was difficult to compare with the same time last year due to last September’s Covid lockdown, Vaughan said.

Paul Beazley, general manager of Harcourts Whangārei, said there were two main reasons behind the increase in supply.

“Properties are sitting on the market a little bit longer, but also we’re pretty much back into what I’d call a traditional market.

“Traditionally you do see a lot more properties come on the market in spring, early summer.”

Beazley said statistics from REINZ showed the median time to sell a property had risen to more than 50 days. This was 30 days at the end of last year.

Although prices were down, the change was not as extreme as in some parts of the country, Beazley said.

“They’ve come off the high for sure, but the Whangārei market and the Northland market don’t tend to have the highs and lows, the peaks that Auckland and Wellington and the larger cities do.

“We just get a bit of a ripple effect from what’s happening there.”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/AEBQ7WPF6CGGOK5XFWVAUSJ7LU.jpg)

Beazley said he was unsure whether prices would drop any further.

“I think we’re back into a normal market although the environment’s different, particularly with things like the cost of living and rising interest rates,” Beazley said.

“Those are definitely having an impact on confidence and sales but how far down the track it will go in terms of whether we see any more drop in price, I don’t know. Only time will tell.”

Mortgage broker Sandeep Maisuriya, of Zest Brokers, said the first home buyer market was active, but the changing interest rates were having an impact on what they could afford.

“It’s too quick, the changes that are happening and that’s what the issue is. By the time they get everything right [with financing], within weeks it could change.”

The two-year fixed interest rate had risen in just the last week, Maisuriya said, from 5.7 per cent to 6.19 per cent.

A low equity margin added to mortgages of first home buyers meant they could be paying 6.5 to 7 per cent interest, he added.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/W55G22T7BIBMUQ24UF453CNPNY.jpg)

The Trade Me data showed asking prices were down just 0.1 per cent in Northland from August to September, to an average of $838,900.

“The region’s all-time high average asking price of $882,200 was recorded in March this year,” Lloyd said.

“If we see dwindling demand continue this, paired with sky-high supply, may result in Northland property prices dropping further coming months.”

Vaughan said Northland’s peak prices were in April this year, but the fall was not as extreme as in some parts of the country, such as Wellington.

“The peak was close to a $1 million and now it’s 5.5 per cent off market peak.”

Wellington prices had dropped 13 per cent since their peak.