Proposed changes to industrial emissions trading scheme allocations could force Golden Bay Cement to review its operations.

Photo / Michael Cunningham

Proposed changes to the Emissions Trading Scheme could jeopardise the ongoing operation of a Northland-based cement manufacturer and put more than 550 jobs at risk.

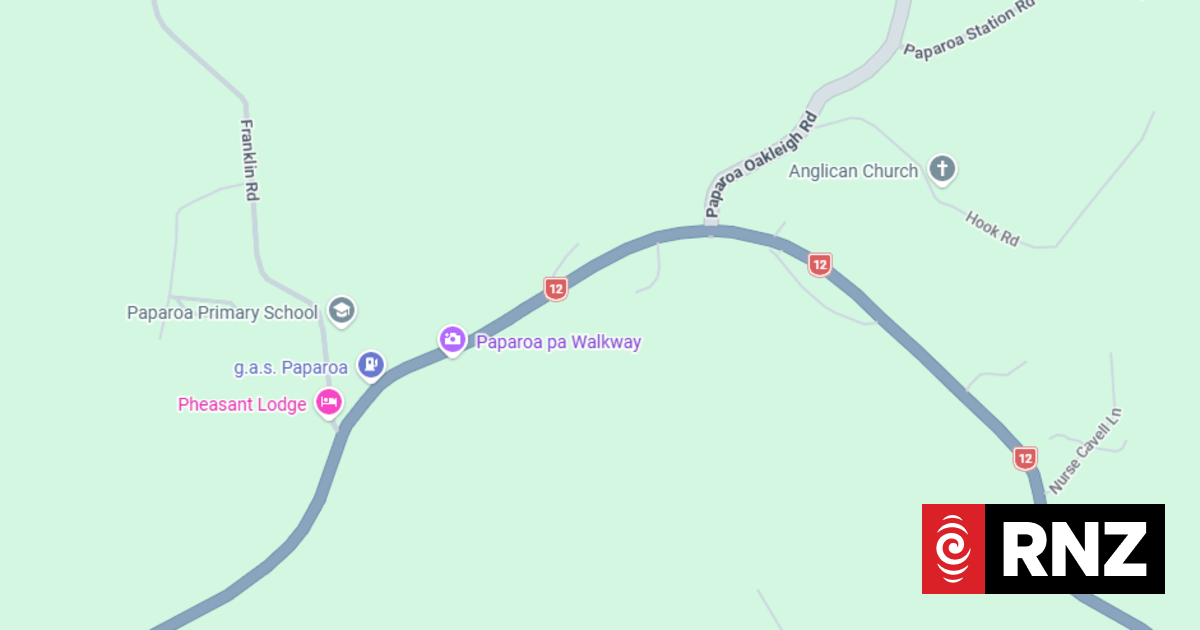

Golden Bay Cement (GBC), just south of Whangārei, said the

Government’s proposed adjustment to the industrial Emissions Trading Scheme (ETS) would introduce material uncertainty, discourage additional investments in carbon reduction and encourage imports of more carbon-intensive clinker.

If Climate Change Minister James Shaw’s plans go ahead, industries will receive fewer subsidies in form of free carbon credits in the future until they are eventually phased out.

The current allocation system for free credits has not changed since the ETS was introduced 12 years ago, Shaw said.

Companies within the ETS must surrender a carbon credit for every tonne of greenhouse gases they emit.

Free credits were introduced to be allocated to protect New Zealand firms against overseas competition – and now, local industries are concerned that they won’t keep up.

“Should this revision proceed, then GBC will be forced to review the ongoing viability of cement manufacturing in New Zealand,” the company said in its submission to the Ministry of Environment on reforming industrial allocation consultation.

GBC is one of the biggest employers in Northland, employing 550 full-time workers and contributing more than 9 per cent of Whangārei’s Gross Domestic Product (GDP).

However, the Portland plant also belongs to group of biggest polluters in the region. Manufacturing accounts for 41 per cent of Northland’s emissions.

GBC supplies about 60 per cent of the country’s cement which has highly specialised qualities due to New Zealand’s unique and stringent building and seismic standards.

The company said it was committed to reducing carbon emissions for the past two decades and, since 2002, GBC has invested more than $200 million in upgrades to its operations.

Significant investments in new technology to reduce the use of fossil fuel in the clinker manufacturing process, notably through the use of biomass and waste tyre recycling, were among the investments GBC undertook that have resulted in a 14 per cent reduction in its clinker carbon intensity over the period.

Clinker is a solid material produced in the manufacture of Portland cement as an intermediary product.

The company said the existing industrial ETS reduction allocation envisioned was very stringent and technically challenging, requiring GBC to fully exploit all existing levers — process efficiency, coal substitution and fully renewable electricity — to be able to achieve the desired lower emissions.

“GBC strongly believes that a carbon tax at the border, such as a carbon border adjustment mechanism, is introduced to ensure that imported clinker and cement are subject to the same carbon intensity framework.”

Without this, GBS said a re-baselining would simply impose a material penalty and disadvantage on local manufacturing, discourage GBC’s ongoing investment in carbon reduction initiatives, and encourage a shift to the use of imported clinker with a far higher carbon footprint.

“It is also important to consider that cement is a critical component of the New Zealand construction industry and economy. The recent Covid-19 pandemic has shown the benefit of strong local manufacturing to ensure supply chain continuity for the New Zealand economy.

“A material re-baselining of the industrial allocations puts this at risk.”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/MIRBI24ZK3VCYLTOELUGOUIDZI.jpg)

Photo / Michael Cunningham

GBC said industrial allocations based on an established baseline have been effective in encouraging significant emissions reductions, to the point where the company was now a world leader in clinker carbon intensity.

“Maintaining the current approach will drive continued investment in emission reduction, rewarding companies that keep ahead of the targets. A one-off update to the baseline would undermine GBC’s proactive approach.

NorthChamber president Tim Robinson said any impact on GBC’s operations would have a huge impact on Northland’s economy in general, as was the case when Refining NZ closed.

“Northland desperately needs high-value employment with a high-income base. Businesses as a whole are pretty nervous with skyrocketing cost of wages and transport costs and all these will fuel a greater inflationary pressure,” he said.

Changes to the ETS industrial allocation are unlikely to take effect until 2024.